Perpetual Inventory System vs Periodic Inventory System: Whats the Difference?

The last (or recent) costs will remain in inventory and be reported as inventory on the balance sheet. Periodic means that the Inventory account is not routinely updated during the accounting period. At the end of the accounting year the Inventory account is adjusted to equal the cost of the merchandise that has not been sold.

Periodic Average

A sales allowance and sales discount follow the same recording formats for either perpetual or periodic inventory systems. The choice between perpetual vs periodic inventory systems depends on the size, complexity, and nature of your business. Even if you’re a small business, that doesn’t mean that the perpetual inventory system isn’t beneficial to you. In choosing an inventory system, you have to weigh the costs and benefits.

Periodic versus Perpetual Inventory Systems

It’s important to note that the choice between these two methods can have a significant impact on a company’s financial statements, particularly in times of fluctuating prices. Therefore, the decision should be made carefully, considering various factors such as the nature of the business, the volatility of prices, the complexity of inventory management, and regulatory requirements. When using the perpetual inventory system, the Inventory account is constantly (or perpetually) changing.

- At the end of the period, a perpetual inventory system will havethe Merchandise Inventory account up-to-date; the only thing leftto do is to compare a physical count of inventory to what is on thebooks.

- Perpetual inventory systems are helpful for those who always need to understand margins and profitability.

- Under Periodic LIFO, the inventory and COGS are updated at the end of the accounting period, not continuously.

- It is far more sophisticated than the periodic system of inventory management.

Advantages and Disadvantages of the Perpetual Inventory System

This requires the use of point-of-sale terminals, barcode scanners, and perpetual inventory software to update estimated inventory with every product purchase and sale. Proponents of perpetual inventory systems don’t always go out of their way to point out the downsides of these systems, the chief of which is the lack of accounting for loss, breakage, or theft. Perpetual inventory systems track sales constantly and immediately with computerized point-of-sale technology. Periodic inventory systems only track sales when a physical count is ordered and require a point-in-time count.

A perpetual inventory system is a program that continuously estimates your inventory based on your electronic records, not a physical inventory. This system starts with the baseline from a physical count and updates based on purchases made in and shipments made out. Perpetual inventory is a continuous accounting practice that records inventory changes in real-time, without the need for physical inventory, so the book inventory accurately shows the real stock. Warehouses register perpetual inventory using input devices such as point of sale (POS) systems and scanners. A periodic inventory system updates and records the inventory account at certain, scheduled times at the end of an operating cycle. The update and recognition could occur at the end of the month, quarter, and year.

When to Use a Perpetual Inventory System

During the year, generic Acetaminophen costs the company $40,000 for materials and labour. On Dec. 31, the company accountants valued the ending inventory at $30,000. A perpetual inventory system tracks goods by updating the product database when a transaction, such as a sale or a receipt, happens.

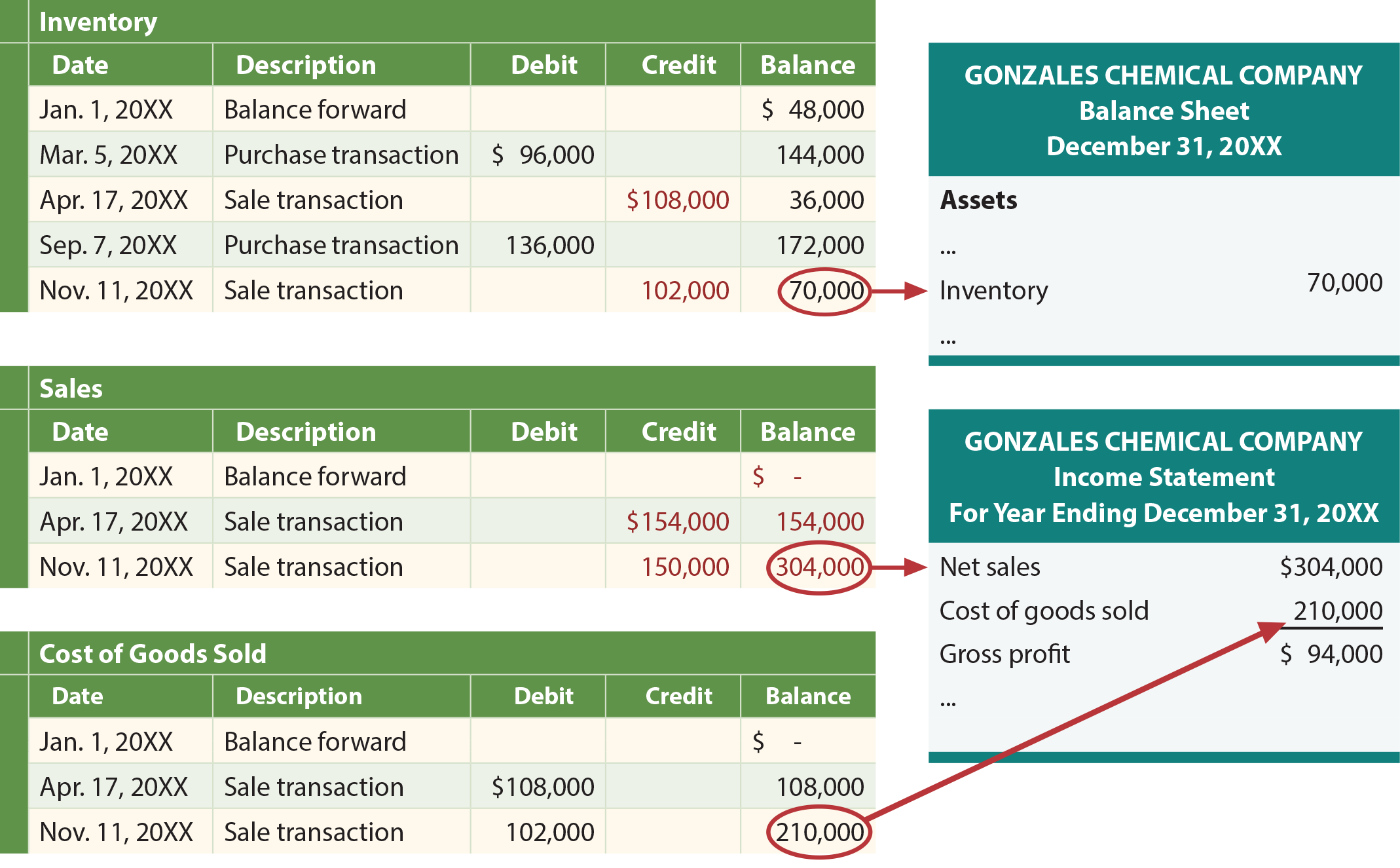

When a company uses the perpetual inventory system and makes a purchase, they will automatically update the Merchandise Inventory account. Under a periodic inventory system, Purchases will be updated, while Merchandise Inventory will remain unchanged until the company counts and verifies its inventory balance. This count and verification typically occur at the end of the annual accounting period, which is often on December 31 of the year. The Merchandise Inventory account balance is reported on the balance sheet while the Purchases account is reported on the Income Statement when using the periodic inventory method. The Cost of Goods Sold is reported on the Income Statement under the perpetual inventory method.

There are advantages and disadvantages to both the perpetual and periodic inventory systems. In the perpetual system, we need to record the COGS at the same time as we record the sale. The entry highlighted depicts the costs transferred from inventory to COGS.

Not only must an adjustment to Merchandise Inventory occur atthe end of a period, but closure of temporary merchandisingaccounts to prepare them for the next period is required. Temporaryaccounts requiring closure are Sales, Sales Discounts, states with no income tax SalesReturns and Allowances, and Cost of Goods Sold. Sales will closewith the temporary credit balance accounts to Income Summary. Overall, once a perpetual inventory system is in place, it takes less effort than a physical system.

Understanding which stock is available at a given time requires constant updates or a perpetual system. The average method can be applied on a perpetual basis, earning it the name moving average. This technique is involved, as a new average unit cost must be computed with each purchase transaction.