Direct Materials Price Variance Definition, Formula, Example, Calculation

A favorable material price variance suggests cost effective procurement by the company. Direct Material Price Variance (DMPV) shows the amount by which the total cost of raw materials has deviated from the planned cost as a result of a price change over a period. An unfavorable one might show supplier problems or rising costs in the industry.

Formula:

Direct material price variance (DM Price Variance) is defined as the difference between the expected and actual cost incurred on purchasing direct materials. It evaluates the extent to which the standard price has been over or under applied to different units of purchase. With our direct material price variance calculator, we aim to help you assess the difference between the actual collector greene county cost of direct materials and the standard cost. To understand more on this topic, check out our unit price calculator and cost of goods sold calculator. Direct materials quantity variance is a part of the overall materials cost variance that occurs due to the difference between the actual quantity of direct materials used and the standard quantity allowed for the output.

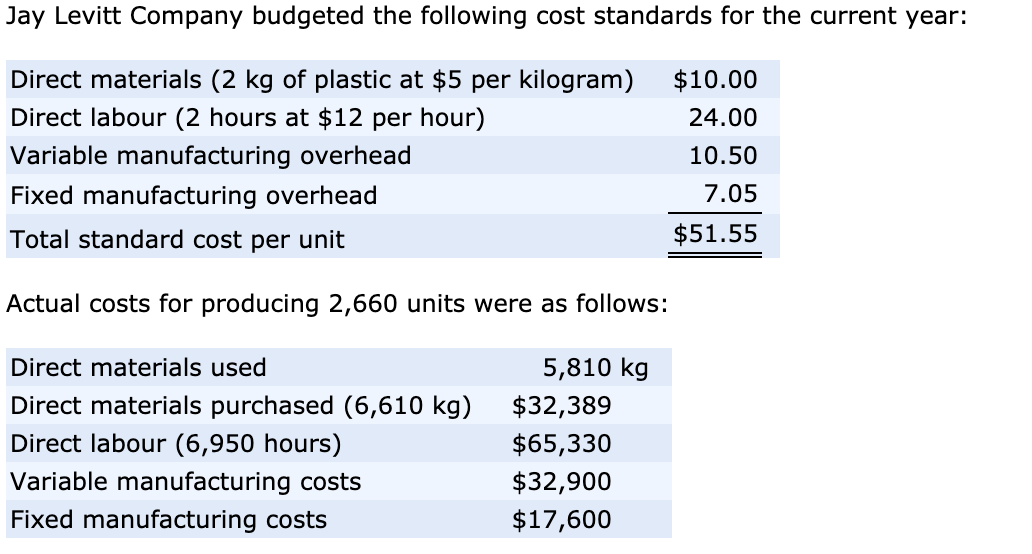

Example: How to Calculate Direct Materials Quantity Variance

Implementing lean manufacturing techniques, investing in modern equipment, and providing ongoing training for employees can enhance production efficiency and reduce material waste. Additionally, regular audits of the production process can identify areas for improvement and help maintain optimal material usage. Direct Material Price Variance is the difference between the actual cost of direct material and the standard cost of quantity purchased or consumed. Direct materials price variance account is a contra account that is debited to record the difference between the standard price and actual price of purchase.

Can a positive variance be bad for my business?

Building strong relationships with suppliers and regularly evaluating their performance can help businesses anticipate and address potential problems before they impact production. Materials price variance represents the difference between the standard cost of the actual quantity purchased and the actual cost of these materials. This year, Band Book made 1,000 cases of books, so the company should have used 28,000 pounds of paper, the total standard quantity (1,000 cases x 28 pounds per case). However, the company purchased 30,000 pounds of paper (the actual quantity), paying $9.90 per case (the actual price). Actual and standard quantities and prices are given in the following table for direct materials to produce 1,000 units. Total actual and standard direct materials costs are calculated by multiplying quantity by price, and the results are shown in the last row of the first two columns.

- After figuring out how much material you used, it’s time to look at the prices.

- The standard cost of actual quantity purchased is calculated by multiplying the standard price with the actual quantity.

- This difference comes to a $13,500 favorable variance, meaning that the company saves $13,500 by buying direct materials for $9.90 rather than the original standard price of $10.35.

- Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

- Actual cost of material is the amount the company paid to supplier to get input for the prodution.

For example, regression analysis might reveal that a 10% increase in supplier lead time results in a 5% increase in material quantity variance. Armed with this knowledge, companies can focus their efforts on improving supplier lead times to achieve better cost control. Additionally, the use of variance decomposition allows businesses to break down complex variances into more manageable components, providing deeper insights into specific areas of concern. The budgeted price is the price that the company’s purchasing staff believes it should pay for a direct materials item, given a predetermined level of quality, speed of delivery, and standard purchasing quantity. Thus, the presence of a direct material price variance may indicate that one of the underlying assumptions used to construct the budgeted price is no longer valid. The direct material price variance is one of two variances used to monitor direct materials.

If the actual purchase price is higher than the standard price, we say that the direct material price variance is adverse or unfavorable. This is because the purchase of raw materials during the period would have cost the business more than what was allowed in the budget. The difference column shows that 200 fewer pounds were used than expected (favorable). It also shows that the actual price per pound was $0.30 higher than standard cost (unfavorable). The direct materials used in production cost more than was anticipated, which is an unfavorable outcome.

In this situation the production manager should be held responsible for the resulting price variance. The direct material price variance is also known as the purchase price variance. The direct material price variance is also known as direct material rate variance and direct material spending variance. You use this part of cost variance analysis to help keep track of spending on materials. Getting a handle on these numbers can lead to better cost control techniques and purchasing decisions down the line. That way, when you crunch numbers for the direct material price variance formula, your results are spot-on.

It’s not just about knowing the number of units but understanding their role in cost variance calculation too. Accurate tracking ensures that any price difference evaluation reflects true production costs. Effective management of direct material variance can lead to significant savings and better resource allocation.

Material price variance analysis helps management identify areas for cost improvement, assess supplier performance, and evaluate the effectiveness of cost control measures. However, it’s essential to consider other factors that may influence costs, such as changes in material quality or production processes, when interpreting variance results. Materials price variance (or direct materials price variance) is the part of materials cost variance that is attributable to the difference between the actual price paid and the standard price specified for direct materials. The direct materials price variance of Hampton Appliance Company is unfavorable for the month of January. This is because the actual price paid to buy 5,000 units of direct material exceeds the standard price.