A Guide to Ecommerce Bookkeeping for Business Owners

Alternatively, you can set up two accounts, a Shipping Income account, and a COGS Shipping Expense account. Flat fees collected from the customer ecommerce bookkeeping go in the former, and payments to shipping vendors go in the latter. You would compare the differences between the two accounts as needed.

What Is Eommerce Accounting Software?

QuickBooks Online Essentials costs an additional $25 per month, which adds features like bill management and time tracking. Unlike QuickBooks Simple Start, which includes access for one user and their accountant, Essentials allows you to add up to three users (plus your accountant). Some key factors you need to consider when selecting the best business accounting software include cost, ease of use, deployment method, scalability, features, and customer support. Visit our guide on how to choose the right small business accounting software for the step-by-step process.

NetSuite Accounting

- Pilot is not a public accounting firm and does not provide services that would require a license to practice public accountancy.

- QuickBooks Online is our best small business accounting software because it is widely used by business owners and accountants, making it extremely easy to find help.

- Having a clear and concise understanding of cash flow is essential for business owners.

- Predominantly, retailers and businesses that have a significant online footprint can benefit the most.

Inventory count and management are the lifeblood of all ecommerce companies. Bookkeeping is a vital component of any business, but especially for ecommerce. Your company will suffer if you don’t know what’s going on with your business bank account. They need to calculate shipping fees and unearned revenue and maintain the general ledger. In the sprawling landscape of eCommerce, managing the financial nuts and bolts of your business can feel a little an impossible task. From tracking sales across multiple channels, dealing with global transactions, to managing inventory, it’s a whirlwind of numbers that would give even seasoned calculators a run for their money.

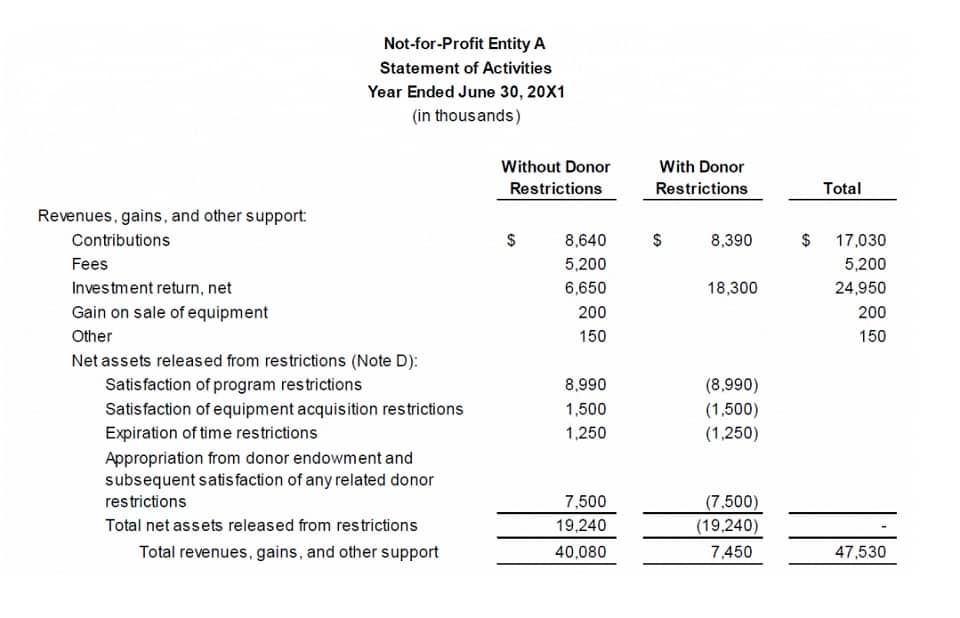

Income Statement

The cash flow statement, also called the statement of changes in financial position, documents a company’s cash inflows and outflows. Sales, cost of goods sold (COGS), gross profit, and operating expenses are all inputs for the income statement. So is operating income, which you generate from day-to-day business activities. Non-operating income is inconsistent and unpredictable, so you can’t rely on it to produce annual profits. Your business must produce a majority of its net income from operating income activities because operating income is sustainable. QuickBooks is by far the most popular and best small business accounting software in the US.

The Tax service starts at $350 and includes the preparation of business property and federal and state tax returns and tax planning. Unless you have significant experience, a lot of the important nuances of ecommerce bookkeeping may be lost in your books. It’s important to make sure any bookkeeping solution you choose, has the ecommerce knowledge you need to get the most from your financials. One of the most complex issues ecommerce sellers need to deal with is sales tax. Sales tax can arise from physical presence in a state – an office, warehouse, employees, or from ’economic nexus’ – selling a certain amount in a specific state. Adding ecommerce integrations is only one piece of the puzzle in making your books ecommerce-friendly.