Current Ratio Guide: Definition, Formula, and Examples

Current liabilities refers to the sum of all liabilities that are due in the next year. The quick ratio (also sometimes called the acid-test ratio) is a more conservative version of the current ratio. Note the growing A/R balance and inventory balance require further diligence, as the A/R growth could be from the inability to collect cash payments from credit sales. The limitations of the current ratio – which must be understood to properly use the financial metric – are as follows. The current ratio reflects a company’s capacity to pay off all its short-term obligations, under the hypothetical scenario that short-term obligations are due right now.

Liquidity Analysis – Why Is the Current Ratio Important to Investors and Stakeholders?

Hence, Company Y’s ability to meet its current obligations can in no way be considered worse than X’s. For instance, the liquidity positions of companies X and Y are shown below. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

- Current assets like cash, cash equivalents, and marketable securities can easily be converted into cash in the short term.

- Companies may attempt to manipulate their current ratio to give investors or lenders a clearer picture of their financial health.

- For example, if a company has $100,000 in current assets and $150,000 in current liabilities, then its current ratio is 0.6.

- For example, companies could invest that money or use it for research and development, promoting longer-term growth, rather than holding a large amount of liquid assets.

- Let’s look at examples of how the current ratio can be used to evaluate a company’s financial health.

Formula

Analyzing a company’s debt levels, including both short-term and long-term, can provide insights into its ability to meet its financial obligations. The current ratio does not consider off-balance sheet items, such as operating leases, which can significantly impact a company’s financial health. A current ratio above 2 may indicate that a company has many cash or other liquid assets that are not used effectively to generate growth or investment opportunities. On the other hand, a current ratio below 1 may indicate that a company may have difficulty paying its short-term debts and obligations.

Example 1: Company A

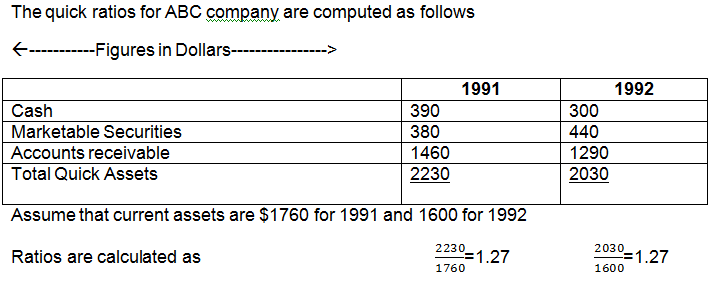

This ratio works by comparing a company’s current assets (assets that are easily converted to cash) to current liabilities (money owed to lenders and clients). A more conservative measure of liquidity is the quick ratio — also known as the acid-test ratio — which compares cash and cash equivalents only, to current liabilities. The current ratio shows a company’s ability to meet stripe in xero its short-term obligations. The ratio is calculated by dividing current assets by current liabilities. An asset is considered current if it can be converted into cash within a year or less, while current liabilities are obligations expected to be paid within one year. The current ratio is a liquidity ratio that measures a company’s ability to meet its short-term obligations.

Over-trading companies are likely to face substantial difficulties in meeting their day-to-day obligations. Ask a question about your financial situation providing as much detail as possible. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Slow-paying Customers – Common Reasons for a Decrease in a Company’s Current Ratio

However, one must remain cautious while making such comparisons, as different industries may have varying industry averages, which can lead to inaccurate conclusions if not considered appropriately. A higher current ratio typically indicates a stronger financial position, as it implies that a company has sufficient resources to settle its short-term obligations. However, it’s essential to compare the current ratio to industry benchmarks, as the optimal level can vary across different sectors. A Current Ratio greater than 1 indicates that a company has more assets than liabilities in the short term, which is generally considered a healthy financial position.

Regular monitoring gives you time to adjust spending, defer expenses, or focus on collections as needed. While the formula is straightforward, the time and effort needed to obtain and verify accurate figures to plug in were often substantial. Liquidity is crucial for financial institutions to meet sudden cash demands during market volatility.

We’ll delve into common reasons for a decrease in a company’s current ratio, ways to improve it, and common mistakes companies make when analyzing their current ratio. The value of current assets in the restaurant’s balance sheet is $40,000, and the current liabilities are $200,000. The current ones mean they can become cash or be paid in less than a year, respectively. These industry-specific examples serve as a guideline for investors and analysts to better understand the ideal current ratio range in relation to the company’s sector of operation.