Expanded Accounting Equation

You can interpret the amounts in the accounting equation to mean that ASC has assets of $10,000 and the source of those assets was the owner, J. Alternatively, you can view the accounting equation to mean that ASC has assets of $10,000 and there are no claims by creditors (liabilities) against the assets. As a result, the owner has a claim for the remainder or residual of $10,000.

Accounting Equation for a Sole Proprietorship: Transactions 7–8

Things that are resources owned by a company and which have future economic value that can be measured and can be expressed in dollars. Examples include cash, investments, accounts receivable, inventory, supplies, land, buildings, equipment, and vehicles. The receipt of money from the bank loan is not revenue since ASI did not earn the money by providing services, investing, etc.

Shareholders’ Equity

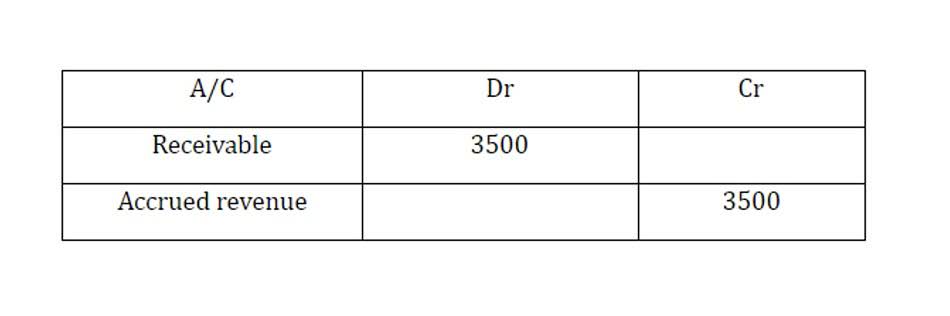

Receivables arise when a company provides a service or sells a product to someone on credit. Regardless of how the accounting equation is represented, it is important to remember that the equation must always balance. For example, if a company becomes bankrupt, its assets are sold and these funds are used to settle its debts first. Only after debts are settled are shareholders entitled to any of the company’s assets to attempt to recover their investment. If the revenues earned are a main activity of the business, they are considered to be operating revenues. If the revenues come from a secondary activity, they are considered to be nonoperating revenues.

Investments

On 28 January, merchandise costing $5,500 are destroyed by fire. The effect of this transaction on the accounting equation is the same as that of loss by fire that occurred on January 20. On 12 January, Sam Enterprises pays $10,000 cash to its accounts payable. This transaction would reduce an asset (cash) and a liability (accounts payable).

What is the difference between an asset and a liability?

The accounting equation shows that one asset increases and one asset decreases. Since the amount of the increase is the same as the amount of the decrease, the accounting equation remains in balance. The purchase of its own stock for cash causes ASI’s assets to decrease by $100 and its stockholders’ equity to decrease by $100.

Equity

Thus, the accounting equation is an essential step in determining company profitability. The accounting equation states that a company’s total assets are equal to the sum of its liabilities and its shareholders’ equity. The accounting equation equates a company’s assets to its liabilities and equity. This shows all company assets are acquired by either debt or equity financing. For example, when a company is started, its assets are first purchased with either cash the company the accounting equation may be expressed as received from loans or cash the company received from investors. Thus, all of the company’s assets stem from either creditors or investors i.e. liabilities and equity.

Sole Proprietorship Transaction #4.

Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn virtual accountant a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own.

- In other words, the accounting equation will always be “in balance”.

- We will assume that as of December 3 the equipment has not been placed into service, therefore, no expense will appear on an income statement for the period of December 1 through December 3.

- If it’s financed through debt, it’ll show as a liability, but if it’s financed through issuing equity shares to investors, it’ll show in shareholders’ equity.

- Assets represent the valuable resources controlled by a company, while liabilities represent its obligations.

- The balance sheet reports the assets, liabilities, and owner’s (stockholders’) equity at a specific point in time, such as December 31.

- The global adherence to the double-entry accounting system makes the account-keeping and -tallying processes more standardized and foolproof.

The earning of revenues also causes stockholders’ equity to increase. The totals now indicate that Accounting Software, Inc. has assets of $16,300. The cash flow creditors provided $7,000 and the stockholders provided $9,300.